When considering the purchase of an Executive Condominium (EC) in Singapore, it's crucial to monitor the current EC Price trends, which are influenced by factors such as location, development size, and unit age. The market has shown a positive upward trend in EC prices, reflecting strong demand for this type of housing that offers condominium-like amenities with public housing benefits. Prospective buyers must consider the five-year minimum occupation period before resale, policy changes affecting subsidy eligibility or grants, and the alignment of their financial situation with market trends to ensure a sound investment. It's also important to evaluate personal income versus expenses to establish a budget that maintains financial stability, analyze resale market dynamics for potential appreciation, and understand the various mortgage options available, including fixed-rate, floating-rate, and split-rate mortgages. Factors like Loan-to-Value (LTV) ratios and the impact of the Total Debt Servicing Ratio (TDSR) on financing must be considered, as they directly affect affordability and the EC Price. Additionally, buyers should explore financial assistance through the Central Provident Fund (CPF) Housing Grants to reduce their financial obligations. Lastly, when choosing between new or resale ECs, investors should consider market dynamics, upcoming area developments, proximity to essential amenities, lease remainder, and the EC's age, as these factors influence long-term value retention and appreciation. A comprehensive approach that combines market analysis with expert advice will help buyers make informed decisions aligned with their investment objectives.

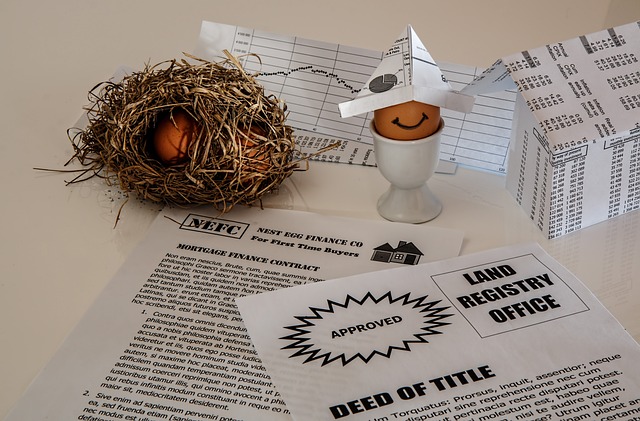

Navigating the real estate market, particularly when it comes to Executive Condominiums (ECs), can be a complex journey for potential homeowners. This article demystifies the pricing trends and financing options available for EC buyers, ensuring you make informed decisions. We’ll explore EC Price dynamics, assess affordability against median income and resale market values, examine various mortgage solutions, understand the implications of Loan-to-Value (LTV) ratios, and leverage CPF Housing Grants effectively. Additionally, we’ll delve into the long-term investment prospects of purchasing an EC, whether new or resale, to aid in your strategic planning for a prosperous future.

- Understanding Executive Condominium (EC) Pricing Trends for Prospective Buyers

- Assessing Affordability: EC Price Relative to Median Income and Resale Market

- Navigating Mortgage Options: EC Financing Solutions for Homebuyers

- The Impact of Loan-to-Value (LTV) Ratios on EC Purchases

- Capitalizing on CPF Housing Grants for EC Acquisition

- Long-Term Investment Considerations: Resale vs. New EC Value Appreciation

Understanding Executive Condominium (EC) Pricing Trends for Prospective Buyers

Prospective buyers interested in an Executive Condominium (EC) should take note of the prevailing pricing trends to make informed decisions. The pricing of ECs can be influenced by a variety of factors, including location, development size, and the age of the unit. Recent market data has shown a steady increase in EC prices, reflecting a robust demand for these housing options that offer a blend of condominium and public housing benefits. To gain a comprehensive understanding of the Executive Condominium Price trajectory, one must analyze historical pricing data, current market conditions, and future projections. This includes monitoring the average transacted price per square foot, as well as the overall price trends across different estates and regions.

Moreover, buyers should consider the timing of their purchase carefully. ECs are subject to a five-year minimum occupation period before they can be sold on the open market, which means that pricing trends in the initial years post-launch may differ from those in subsequent years. By understanding these dynamics and keeping abreast of policy changes that affect EC pricing—such as eligibility criteria for subsidies or grants—prospective buyers can better anticipate how the Executive Condominium Price might shift in the future. This strategic insight is crucial for those looking to maximize their investment potential or secure a dwelling that suits their lifestyle and financial planning.

Assessing Affordability: EC Price Relative to Median Income and Resale Market

When considering the purchase of an Executive Condominium (EC), it’s crucial to evaluate its price in relation to your personal income and the resale market trends. Prospective buyers should first assess their monthly income and expenses to determine a comfortable affordability range, ensuring that the EC price aligns with this assessment. The median income of the area serves as a benchmark for affordability; it provides a general indicator of what a typical household earns, which is pivotal in understanding whether the EC represents a sound financial investment without overstretching your finances. Additionally, examining the resale market offers valuable insights into the property’s potential appreciation value and liquidity should you need to sell in the future. A robust resale market can signal stable demand, which may positively influence the EC’s long-term value. By analyzing both personal financial standing and market conditions, buyers can make a more informed decision, aligning their purchase with their long-term financial goals.

Navigating Mortgage Options: EC Financing Solutions for Homebuyers

When embarking on the journey to purchase an Executive Condominium (EC), understanding the financing options available is pivotal. Prospective buyers must consider the unique nature of ECs, which are a hybrid of public and private housing in Singapore, subject to certain resale restrictions. Mortgage solutions tailored for ECs can offer competitive price points compared to traditional condominiums, making them an attractive option for both families and investors alike. To navigate these options effectively, buyers should first familiarize themselves with the different types of home loans available, including fixed-rate, floating-rate, and split-rate mortgage schemes. Each has its own advantages and risks associated with interest rate fluctuations.

In addition to exploring various loan structures, it is advisable for buyers to assess their financial situation thoroughly. This includes evaluating their income stability, existing debts, and personal financial commitments. The Total Debt Servicing Ratio (TDSR) framework implemented by the Monetary Authority of Singapore serves as a guide to ensure that one’s monthly mortgage payments do not exceed a certain percentage of their monthly income. By carefully considering these factors and consulting with financial advisors or mortgage brokers who specialize in EC financing, buyers can make an informed decision on the most suitable mortgage option for their specific needs, ultimately leading to a more secure and satisfying homeownership experience.

The Impact of Loan-to-Value (LTV) Ratios on EC Purchases

When considering an Executive Condominium (EC) purchase, understanding the implications of Loan-to-Value (LTV) ratios is crucial for a financially sound investment. LTV ratios determine the maximum loan amount a financial institution is willing to extend to a buyer based on the property’s value. In Singapore, where ECs serve as an affordable alternative to private condominiums, LTV ratios directly impact purchase affordability and can influence the price at which an EC is valued. For instance, a higher LTV ratio means a buyer can finance a larger portion of the Executive Condominium Price with a loan, potentially making it more accessible while also necessitating lower down payment requirements. Conversely, a lower LTV ratio would require buyers to put down a larger initial payment and secure less leverage financing, which could affect their overall investment strategy. Prospective EC buyers should assess their financial capacity in light of the prevailing LTV ratios, as these can vary over time and are subject to changes by the Monetary Authority of Singapore. By doing so, they can navigate the property market with a clearer understanding of the financing landscape and make informed decisions that align with their long-term financial goals.

Capitalizing on CPF Housing Grants for EC Acquisition

When considering the acquisition of an Executive Condominium (EC), prospective buyers in Singapore often explore the potential financial support available through the Central Provident Fund (CPF) Housing Grants. The CPF scheme is a significant component of Singapore’s socio-economic landscape, designed to assist individuals with their housing needs. For eligible buyers, capitalizing on the CPF Housing Grant can substantially alleviate the financial burden associated with purchasing an EC. The grant amount one may be entitled to depends on various factors, including the buyer’s income level, family nucleus, and the type of EC purchased. It is imperative to understand the intricacies of the grant’s eligibility criteria and the maximum quantum that can be utilized towards the purchase of an EC, as this can vary. Prospective buyers should thoroughly review the latest regulations governing CPF Housing Grants to ensure they are well-positioned to benefit from this scheme when purchasing an Executive Condominium. The Executive Condominium Price (EC Price) is a critical consideration in this process, as it dictates the extent of the grant that can be applied. By leveraging the CPF Housing Grant in conjunction with careful budgeting and financial planning, buyers can navigate the property market more confidently and affordably. It is advisable to engage with professionals or consult the CPF Board for personalized advice tailored to one’s unique financial situation. Understanding the interplay between the EC Price and the CPF Housing Grant ensures that potential buyers can maximize their savings and make informed decisions when purchasing an Executive Condominium.

Long-Term Investment Considerations: Resale vs. New EC Value Appreciation

When considering an Executive Condominium (EC) as a long-term investment, potential buyers must weigh the benefits of resale units against the value appreciation of new ECs. Resale ECs offer immediate occupancy and mature estates with established amenities and infrastructure, which can be appealing for those looking to live in their home without the wait for completion. However, the pricing of resale units is often influenced by market demand, condition of the unit, and location. On the other hand, opting for a new EC from the developer provides the latest facilities and designs tailored to contemporary living standards. New ECs come with a fresh 99-year leasehold tenure commencing from the date of takeover upon completion. This means that they may potentially appreciate in value as the development matures, provided the estate continues to be well-maintained and the locale remains desirable.

Investors should consider the Executive Condominium Price trends and future developments planned for the area where the EC is situated. Factors such as the proximity to public transport, schools, commercial hubs, and leisure facilities can significantly impact the resale value of an EC. Additionally, the lease remainder and the age of the EC will play a crucial role in its depreciation over time. A newer EC with a longer remaining lease will typically retain its value better than an older one. It’s important for buyers to conduct thorough research and consult with real estate experts to understand the nuances of investment appreciation in the EC market, ensuring their purchase aligns with their long-term financial goals and investment horizon.

When venturing into the realm of Executive Condominium (EC) ownership, prospective buyers must navigate a complex array of financial considerations. This article has demystified EC pricing trends, enabling you to assess affordability and explore various mortgage options tailored to your needs. Understanding the nuances of Loan-to-Value (LTV) ratios and leveraging CPF Housing Grants can significantly enhance your purchasing power and investment strategy. Whether you’re considering a new EC or a resale unit, the insights provided will aid in making informed decisions about long-term value appreciation. By carefully evaluating each aspect of EC financing, you’ll be better positioned to secure an Executive Condominium that fits both your current financial situation and future aspirations.